Table of Content

When figuring out how much you can afford, you need to make sure that you take every single fee and expense into account. Many mortgage programs and home loan products have hidden fees; on the outset, they aren't very obvious. By the time everything is said and done, though, they can increase a borrower's expenses by a considerable margin. For your convenience current Los Angeles VA loan rates are published below.

The letter will stipulate the greatest amount of qualification pertaining to your income. This procedure and letter will give your offer more clout over other buyers. Our entire contact information, including address, phone number, and email will be included on the pre-approval letter. It's imperative in today's real estate market to be viewed as a serious buying candidate. Use the resources that California Veterans Home Loan Center has available. Your back-end DTI ratio calculates how much of your gross income goes towards other types of debt such as credit cards, student loans and car loans.

Other Common Fees Paid at Closing

The client had purchased a house for $1.7 million a few years earlier with 10% down, but didn’t use a VA loan. Under the prior VA rules, refinancing would have required his client to boost his home equity. Instead, Mr. Banning provided a refinance of $1.62 million with no additional money down. Since rates fluctuate, there is no point in documenting how much you are going to pay in interest for a VA home loan. Suffice it to say that it is generally a great deal less than you would pay for many other popular mortgage products. There are a variety of factors that play into the calculation of your monthly loan payment.

Nine out of ten people who secure a VA loan take advantage of this benefit and put no money down when buying a home. Without question, this is a major selling point for many people. If you were 10% or more disabled while in service, your funding fee can be waived. Set "finance the funding fee" to No and deduct that number from your cash due at closing to get your actual closing costs.

How to Qualify for a VA Home Loan

Bankrate is an independent, advertising-supported comparison service. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. If you are VA disabled, you do not have to pay the VA funding fee. Those who are not disabled and previously used a VA loan will pay a higher VA funding fee than the first VA loan use. For the most accurate estimate, we recommend filling out all relevant fields.

This is an estimate of how much you will need on the day your home purchase is made. The lender is headquartered in Columbia, Missouri, and specializes in VA loans; however, it also offers a variety of other loan products. It’s a popular choice among military borrowers and has become a leader in the VA loan sector, providing more VA purchase loans by volume than any other lender since 2016.

How our VA loan calculator works

Although lenders don’t use this ratio to qualify you, it’s still essential in helping you figure out how much house you can afford. Your debt-to-income ratio is the relationship between your income and how much you spend each month on debt. For example, if your total monthly debt is $720 and your monthly income is $2,000, your DTI would be 36 percent. If you have less-than-perfect credit, lenders might consider you a riskier borrower and charge you more for a home loan. Your debt-to-income ratio will help you understand more about your total monthly debt and home affordability, which we’ll cover in more detail later.

The funding fee rate for VA-backed refinanced loans doesn't change based on your down payment amount. If you purchase a manufactured home, you also only need to pay the first-time use funding fee rate. The price is the amount you paid for a home or plan to pay for a future home purchase. Buying a home with a lower purchase price can help lower the monthly mortgage payment. Enter your home price into the VA loan payment calculator above. As the name implies, the VA home loan program is reserved for veterans and active members of the United States military.

It can depend upon several factors, including the number of times you have borrowed a VA loan. The annual property tax is an estimation based on the home's purchase price. The total is divided by 12 and applied to each monthly mortgage payment. If you know the specific amount of taxes, you can add it as an annual total or percentage.

Either way, you're going to be paying a lot less than those who don't qualify for VA loans are going to. Also, without the worry of private mortgage insurance and without having to make a down payment, you're going to be ahead of the game financially anyway. In fact, the relaxed conditions for VA home loans makes any time a good time to get one. The VA loan benefit is flexible and widely used across the country. Use this calculator to help estimate closing costs on a VA home loan. Enter your closing date, the sale price, your military status & quickly see the estimated closing cost.

Either the house meets all the MPRs and gets approved by the appraiser, or the appraiser orders some repairs to be done before the closing. A VA loan appraisal is an assessment conducted by an appraiser to determine the property’s actual worth and ensure the property meets all of the MPRs. The house must be a single dwelling that is legally considered to be real estate and is readily marketable. Here are all of the MPRs your property must meet to qualify for the loan. MPRs or Minimum Property Requirements are certain conditions the VA requires your house to meet to qualify for a VA loan.

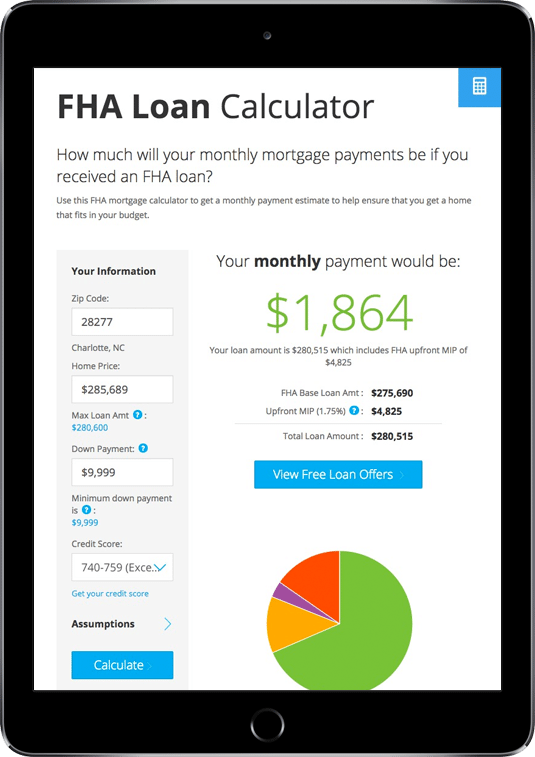

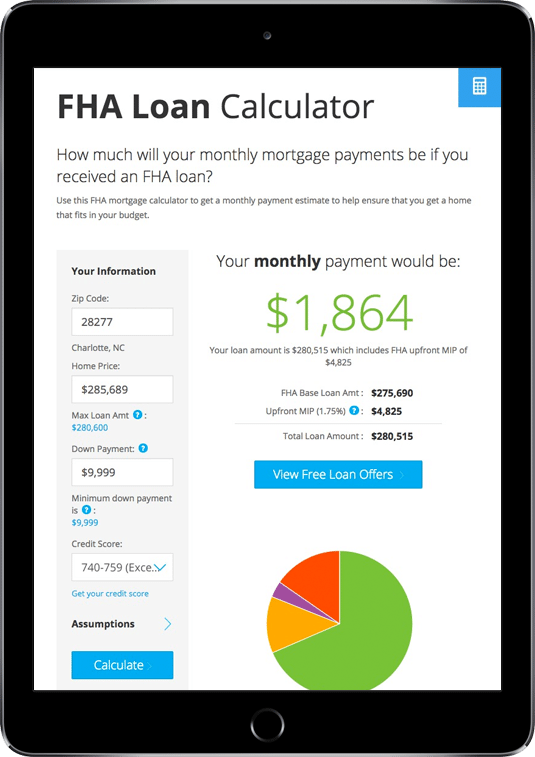

This free VA Home Loan calculator from Veterans United Home Loans gives you a snapshot of what your monthly payments would be with a VA Loan. Use this mortgage calculator to determine your monthly payments and find the right home to fit your budget. Using the VA mortgage calculator can help you estimate of your monthly mortgage payments before you commit to purchasing a property.

Choosing a short loan term increases your monthly payments significantly. However, it also reduces the interest rate, which helps you save thousands over time. Selecting an extended loan term will decrease your monthly payments but raise your interest rates. Selecting a longer term would mean lower monthly payments but higher interest rates. A VA loan mortgage calculator is a tool for estimating your monthly payments.

Points are generally more advantageous to borrowers who plan to own the home for a longer period of time. Your loan officer can help you determine the break-even point of purchasing discount points, or if points even make sense for your specific situation. This free VA mortgage refinance calculator gives you a look at your potential monthly savings with VA Refinance Loans. To get exact figures, contact Veterans United Home Loans and speak with a home loan specialist.

Mortgage insurance is required for most people who have less than 20% equity in their homes, in order to protect their lenders in the case of default. Since the U.S. government guarantees a portion of every VA loan, private mortgage insurance - or PMI - is not required. This shaves a significant amount of money from the average monthly payment of those who participate in the VA home loan program. For instance, if you are borrowing a loan amount of $153,450 at an interest rate of 3.125% and choose not to make a downpayment, your estimated monthly payment will be $852. Use the VA mortgage calculator to quickly estimate your monthly payment for a VA loan or VA refinance. The VA loan is available to most active-duty military and veterans for no money down.

For VA-backed purchase and construction loans, your funding fee rate will be based on your down payment amount and loan usage. If you used a VA-backed loan to purchase a manufactured home in the past, you'll still pay the first-time funding fee rate. Enter your ZIP code and the calculator will take your county's VA loan limits into consideration to let you know if a down payment is required. When shopping around for a mortgage, many people wonder if there is a "good time" to apply.

No comments:

Post a Comment